XRP Price Prediction: Can It Reach $10 Amid ETF Hype and Institutional Demand?

#XRP

- Technical indicators show XRP is primed for a potential breakout above its 20-day MA

- Unprecedented institutional interest (ETFs, Ripple's $4B commitment) could drive long-term value

- Market volatility presents both opportunities and risks for short-term traders

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

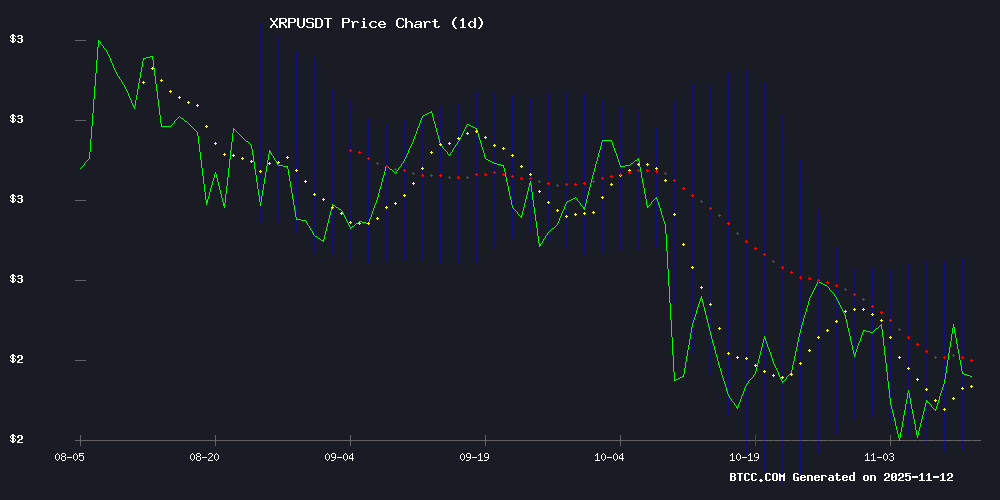

According to BTCC financial analyst Olivia, XRP is currently trading at 2.38540000 USDT, slightly below its 20-day moving average (MA) of 2.4431. The MACD indicator shows a bullish crossover with values at 0.0936 (MACD line), 0.0468 (signal line), and 0.0469 (histogram). Bollinger Bands suggest a potential reversal, with the price NEAR the lower band at 2.1767, while the upper band sits at 2.7096. Olivia notes that a break above the 20-day MA could signal upward momentum.

XRP Market Sentiment: Institutional Interest Heats Up

BTCC financial analyst Olivia highlights a surge in bullish sentiment around XRP, driven by news of institutional adoption. Key developments include the launch of the first spot XRP ETF, Ripple's $4 billion push for institutional adoption, and analyst predictions of a rally toward $10. Olivia cautions that while the news is positive, traders should monitor technical levels for confirmation of a sustained uptrend.

Factors Influencing XRP’s Price

BitGo's Evernorth-Activated Wallet Sparks XRP Network Activity Surge

BitGo's wallet infrastructure has entered an anomalous operational phase, generating thousands of XRP addresses daily. Chain analysis reveals precise 1.2225 XRP allocations to each newly created address from the Initialization Wallet that originally activated the Evernorth address.

The systematic funding pattern suggests institutional-grade wallet preparation rather than retail activity. Such precise, repetitive transactions typically precede large-scale operational deployments in blockchain networks.

Canary Funds XRP ETF Set for Launch This Thursday After Final Filing

Canary Funds is poised to launch the first pure-play spot XRP ETF this Thursday, following final regulatory approval. The fund, trading under the ticker "XRPC" on Nasdaq, will directly hold XRP tokens—a structural advantage over indirect exposure products. Analysts project $5 billion in inflows during its debut month.

The SEC's green light clears the last hurdle for the ETF, with Nasdaq certification expected by Wednesday evening. Bitwise and other firms are also preparing competing XRP ETFs, signaling growing institutional demand for direct crypto exposure.

This landmark product marks a maturation point for XRP markets, offering regulated access without offshore vehicle complexities. Market makers anticipate heightened volatility as arbitrage opportunities emerge between spot and derivatives markets.

First 33 Act-Compliant Spot XRP ETF Launches Today

Just over a year after the SEC appealed a court ruling that XRP did not qualify as a security, the regulatory environment for cryptocurrencies has undergone significant transformation. The first '33 Act-compliant spot XRP ETF launches Thursday, marking a historic industry milestone. This event underscores the rapid evolution of crypto regulations and market acceptance, offering investors a novel method to access XRP directly.

Top Two ‘Whale Approved’ Altcoins To Stack For Massive December Rally

The U.S. Senate's passage of a bill to end the government shutdown signals imminent liquidity injection into global markets. With the U.S. Treasury General Account balance exceeding $1 trillion, risk assets—including cryptocurrencies—stand to benefit from renewed capital flows.

XRP emerges as a focal point for institutional accumulation, with over $56 million withdrawn from exchanges. Banking adoption prospects, regulatory clarity via the Clarity Act, and potential ETF approval form a trifecta of bullish catalysts. Analysts project a near-term target of $1.90-$2.00, with a subsequent rally toward $6.00 if key resistance levels break.

Ripple Labs Targets Wall Street with Bold Crypto Strategy

Ripple Labs is aggressively pivoting toward institutional finance, aiming to embed its XRP cryptocurrency into Wall Street's infrastructure. The move signals a strategic expansion beyond cross-border payments, targeting deeper integration with traditional financial systems.

The company has deployed nearly $4 billion in acquisitions, including Hidden Road's institutional credit network and Rail's stablecoin-powered payments platform. These investments underscore Ripple's commitment to scaling blockchain solutions for enterprise use cases.

CEO Brad Garlinghouse hints at a potential acquisition slowdown as the firm shifts focus toward product consolidation. The strategy reflects a calculated effort to position XRP as a bridge between digital assets and legacy finance.

XRP Price Faces Volatility Amid ETF Approval Anticipation

XRP's price retreated to $2.45 after briefly touching $2.57 this week, as traders digested the imminent launch of exchange-traded funds tied to the cryptocurrency. Nine XRP ETFs have been pre-listed on the Depository Trust & Clearing Corporation, with Bloomberg analysts forecasting trading to commence imminently.

The REX-Osprey XRP ETF has already attracted $120 million in assets, signaling strong institutional interest. JPMorgan projects over $8 billion in inflows during the first year of ETF operations—a potential catalyst for XRP's valuation. Yet market veterans caution that the approval may already be priced in, leaving room for a 'sell-the-news' scenario.

Ripple Bets $4 Billion on XRP's Institutional Adoption Amid Blockchain Finance Push

Ripple has deployed nearly $4 billion in strategic acquisitions this year, signaling an aggressive pivot toward institutional blockchain adoption. The San Francisco-based firm is positioning XRP as a bridge between decentralized finance and traditional banking infrastructure.

CEO Brad Garlinghouse unveiled Ripple Prime at Swell 2025—a U.S.-regulated brokerage service providing institutional OTC access to XRP and digital assets. "We're building the settlement layer for tomorrow's financial systems," he declared, emphasizing XRP Ledger's growing role in cross-border transactions.

Despite XRP's stagnant price action throughout 2025, Ripple continues expanding the token's utility. The company recently acquired three financial technology firms specializing in compliance and liquidity solutions, betting that regulated crypto products will drive long-term demand.

XRP Price Prediction: Renewed Institutional Confidence Sparks Rally Toward $10

XRP has surged 11% to $2.55 amid growing institutional interest, fueled by Ripple's $40 billion valuation and new cross-border partnerships in Asia and the Middle East. Analysts now see a path to $10 if the token breaks key resistance levels, with speculation mounting about potential spot ETF filings.

Market sentiment has shifted dramatically from earlier stagnation, as traders anticipate inflows comparable to Bitcoin and Ethereum's ETF-driven rallies. Technical indicators suggest $3.20 as the next critical threshold—a breach could propel XRP toward $4.50 and beyond.

Smaller payment-focused tokens like Remittix (RTX) are gaining attention as altcoin season gains momentum, though XRP remains the primary beneficiary of renewed institutional flows. The ecosystem's growth contrasts sharply with its regulatory challenges just months ago.

Canary Capital Files for First U.S. Spot XRP ETF, Nasdaq Listing Imminent

Canary Capital has taken a decisive step toward launching the first U.S. spot XRP exchange-traded fund, filing a Form 8-A with the SEC. The registration paves the way for trading to commence as early as November 13 under the ticker "XRPC" on Nasdaq, pending final exchange approvals.

The grantor trust structure will hold physical XRP tokens—not derivatives—with U.S. Bank serving as cash custodian and Gemini/BitGo safeguarding the digital assets. Pricing will track CoinDesk's XRP CCIX New York Rate, offering investors direct exposure to the cryptocurrency's market performance through 10,000-share creation baskets.

This move signals growing institutional acceptance of XRP despite regulatory uncertainties. The ETF's structure mirrors successful physical Bitcoin products, suggesting crypto investment vehicles are maturing beyond futures-based offerings.

Canary Capital's XRP ETF Nears Launch as Market Awaits Price Impact

XRP faces a pivotal moment as Canary Capital prepares to launch its XRP ETF, potentially as soon as Thursday. The fund's FORM 8-A filing—a final regulatory step—mirrors the pattern seen before Canary's HBAR ETF debut earlier this year. Analysts note the timing coincides with the U.S. government's post-shutdown reopening, which may accelerate pending crypto ETF approvals.

Despite the bullish catalyst, XRP's price dipped 3% to $2.43 amid broader market weakness. The token's muted reaction reflects lingering uncertainty, though institutional adoption via ETFs could reshape its trajectory. "All boxes are being checked," observed Bloomberg ETF analyst Eric Balchunas, signaling readiness for launch.

Analysts Bullish on XRP Despite Sideways Trading, Predict $10-$37 Rally

XRP's prolonged consolidation is testing investor patience, but prominent analysts see significant upside potential. EGRAG, a widely-followed market observer, maintains a bullish stance with price targets ranging from $10 to $37 for the current market cycle.

The token's ability to sustain current levels during market turbulence suggests underlying strength. Technical analysts point to historical patterns that could foreshadow a breakout, though timing remains uncertain amid broader crypto market fluctuations.

Is XRP a good investment?

BTCC financial analyst Olivia provides a balanced view on XRP as an investment:

| Factor | Details |

|---|---|

| Technical Outlook | Neutral-bullish (MACD crossover, Bollinger Band squeeze) |

| News Catalysts | ETF launches, institutional adoption ($4B Ripple push) |

| Price Targets | Short-term: $2.70 (upper Bollinger), Long-term: $10+ (analyst consensus) |

| Risks | Regulatory uncertainty, market volatility |

Olivia suggests dollar-cost averaging for risk-averse investors, while active traders might capitalize on ETF-related volatility.